alabama delinquent property tax laws

Unless the Property is paid in full the Owner may lose any ownership rights to it. 2 Assessor Collector Delinquent Taxes and Tax Sales Chickasaw County Assessor and Collector First District 1 Pinson Square Room 3 Houston MS 38851 Phone 662456-3327 Second District 234 West Main St Okolona.

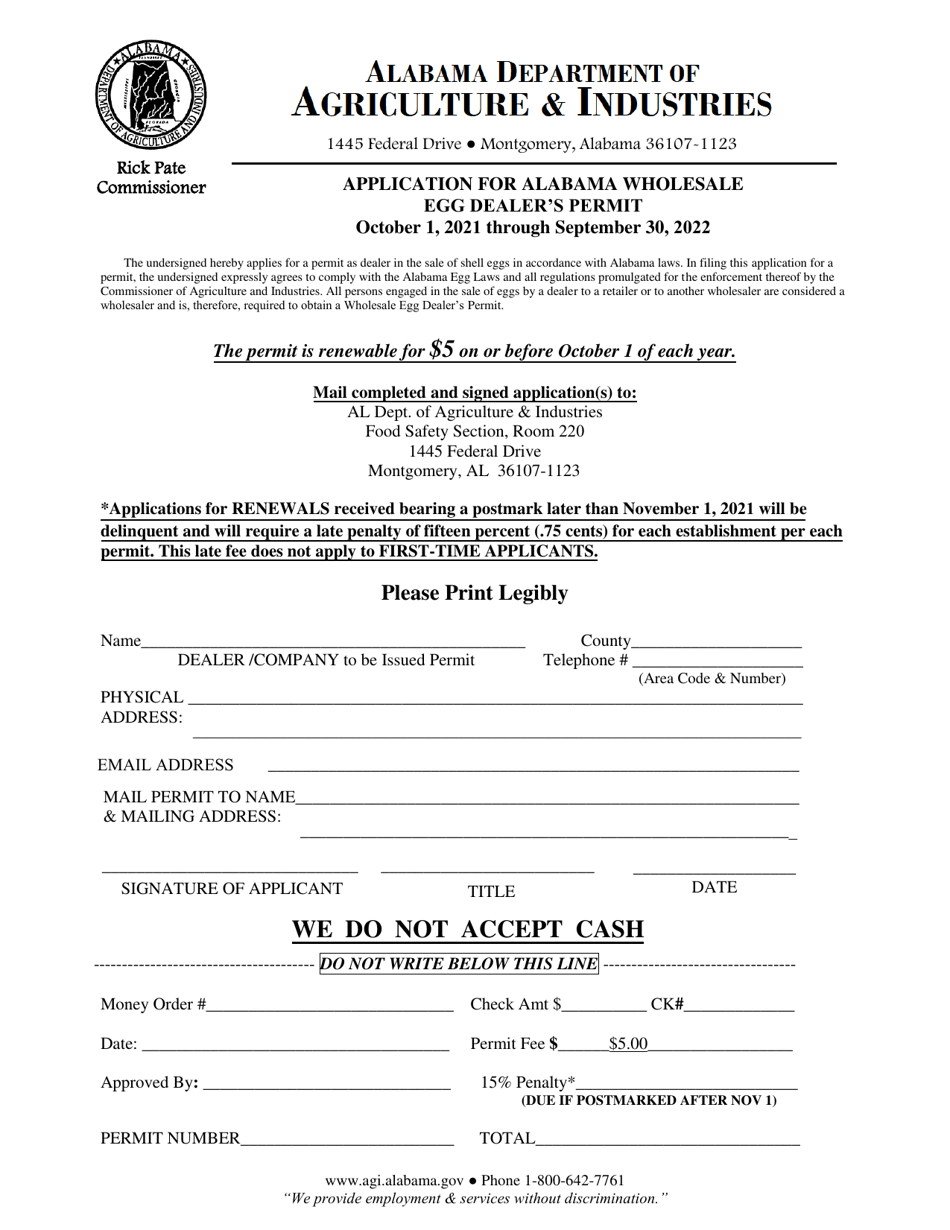

2022 Alabama Application For Alabama Wholesale Egg Dealer S Permit Download Fillable Pdf Templateroller

Alabama Delinquent Property Tax Laws.

. At what point will my tax delinquent property be sold for taxes. State laws allow the local government to sell homes as part of a tax sale process to collect delinquent taxes from home sales are legalized in all states. View How to Read County Transcript Instructions.

Alabama Tax Lien Certificates. In Alabama taxes are due on October 1 and become delinquent on January 1. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land.

The Alabama Senate has a companion Bill SB261 that is waiting on the call of the chair to bring the Bill to a vote. Code 40-10-120. On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your COUNTY.

Tax Assessor and Delinquent Taxes. In 2019 beginning with tax year 2018 delinquent properties Baldwin County Revenue Commission decided to migrate to the sale of tax liens. Transcripts of Delinquent Property.

Can I get a deed to the tax delinquent property if I pay the taxes. Alabama tax lien certificates are sold at County Tax Sales during the month of May each year. Created by Lina Castro on Dec 30 2020.

You may redeem your property within 3 years of sale by paying all taxes interest fees and penalties at the rate of 12 per annum. It can be such an overwhelming venture with taxes to file possible court proceedings to endure and more that the services of a professional might be welcome especially in getting help understanding the intricacies of Alabama inheritance laws. In etowah county alabama real estate property taxes are due on october 1 and are considered delinquent after december 31st of each year.

Section 40-10-142 Lien and sale of property for unpaid installments of taxes - Disposition of money. The original owner has 3 three years to redeem his or her interest in the property. Property Search and GIS Maps.

Section 40-10-143 Lien of persons other than holders of legal title for expenses of redemption. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state.

If another party buys the lien you may redeem the property at any time within three years from the date of the sale. To redeem the delinquent owner must tender the amount the purchaser paid to buy the Mobile County Alabama tax lien certificate plus any additional property tax the purchaser has paid up to the expiration of the 3 three year redemption period plus 12 per annum Sec. If the property has been tax delinquent for less than three years the state will assign the propertys tax sale certificate to you.

According to Alabama law you must file your taxes on October 1 and your taxes become delinquent on January 1. The Property Tax Division makes the Book of Lands available for purchase and open for public inspection between 800 AM and. If the Property is sold by law due to non-payment of Taxes the Owner has three years or more to withdraw his ownership rights.

How Long Can Property Taxes Go Unpaid In Alabama. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. You can therefore refuse to pay any of the current local property taxes on your Alabama home so the county treasurer can sell a tax lien certificate to anyone.

Our vision is to assure the citizens of Alabama that compliance with the property tax laws rules and regulations is maintained in an efficient and effective manner. Where can I find a list of tax delinquent property. January 30 2022632 pm.

To report a criminal tax violation please call 251 344-4737. The reason I capitalized MAY COUNTY will be evident. Do I have the option to redeem my tax delinquent property.

If you feel justifies a delinquent tax amount deemed. In order and avoid costly penalties and often property owners must time their 2019 property tax or by January 31 2020 These tax statements. The transcripts are updated weekly.

The winning bidder at an Alabama tax sale is the bidder with the greatest bid. 40-10-16 the winning bidder at the Etowah County Alabama tax sale is the bidder who pays the largest. State law allows taxes to be paid by persons other than the owners.

Alabama delinquent property tax laws Monday March 14 2022 Edit. Tax Delinquent Properties for Sale Search. Below is a listing by county of tax delinquent properties currently in State inventory.

The bidding begins at just the back taxes owed. Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home. CODE 40-10-180 THROUGH 40-10-200The second mechanism for Alabama counties to collect delinquent taxes was more firmly established by the Alabama legislatures enactment of HB354 in 2018.

Search Tax Delinquent Properties. Once there is a tax lien on your home the taxing authority may hold a tax lien sale. Once you have found a property for which you want to apply select the CS Number link to generate an online.

All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. If you fail to pay your property taxes in Alabama your home could become liened if you owe more than the delinquent amount. If it has been tax delinquent for three years or more the state will issue you a tax deed for the property.

Article 6 Refund of Taxes Paid by Mistake or Error. Section 40-10-141 Lien and sale of property for unpaid installments of taxes - Procedure. 2018 Alabama Tax Lien law changes.

Jefferson County Tax Collector

Buy Alabama Tax Lien Certificates Or Tax Deeds In Hoover Al

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Lien Certificates And Tax Deeds In Alabama Youtube

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Jefferson County Tax Collector

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas