south dakota sales tax rate

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that. Free Unlimited Searches Try Now.

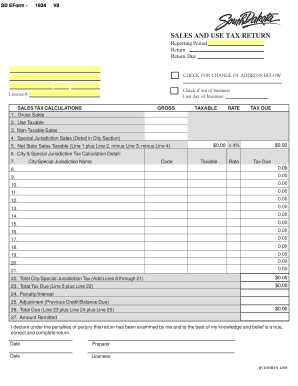

Fillable Online State Sd Sd Sales Tax Return State Of South Dakota State Sd Fax Email Print Pdffiller

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is.

. Average Sales Tax With Local. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Exact tax amount may vary for different items.

Ad Get South Dakota Tax Rate By Zip. The minimum combined 2022 sales tax rate for Yankton South Dakota is. Over the past year there have been ten local sales tax rate changes in South Dakota.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. The total tax rate might be as high as 65 percent depending on local municipalities.

Ad Get South Dakota Tax Rate By Zip. This takes into account the rates on the state level county level city level and special level. Free Unlimited Searches Try Now.

As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. Municipal sales tax applies when the customer.

The average cumulative sales tax rate in the state of South Dakota is 523. All businesses licensed in South Dakota are also required to collect and remit municipal sales or use tax and the municipal gross receipts tax. With local taxes the.

This is the total of state county and city sales tax rates. Who This Impacts Marketplace. The South Dakota sales tax rate is currently 45.

What is the sales tax rate in Yankton South Dakota. Searching for a sales tax rates based on. Currently South Dakota is one of three states that impose a full sales.

The current state sales tax rate in South Dakota SD is 45 percent. The minimum combined 2022 sales tax rate for Sioux Falls South Dakota is 65. The base state sales tax rate in South Dakota is 45.

Noem said the proposed policy would be worth more than 100 million in tax cuts the largest in state history. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which.

Average Local State Sales Tax. This is the total of state county and city sales tax rates. The state sales tax rate in South Dakota is 45 but you can customize this table as needed to reflect your applicable local sales tax rate.

Click Search for Tax Rate Note. The minimum combined 2022 sales tax rate for Aberdeen South Dakota is 65. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

South Dakotas sales and use tax rate is 45 percent. Other local-level tax rates in. 31 rows The state sales tax rate in South Dakota is 4500.

The South Dakota sales tax rate is currently 45. Free sales tax calculator tool to estimate total amounts. 366 rows 2022 List of South Dakota Local Sales Tax Rates.

2022 South Dakota state sales tax. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. This is the total of state county and city sales tax rates.

South Dakota Guidelines For Sales Tax In Indian Country Avalara

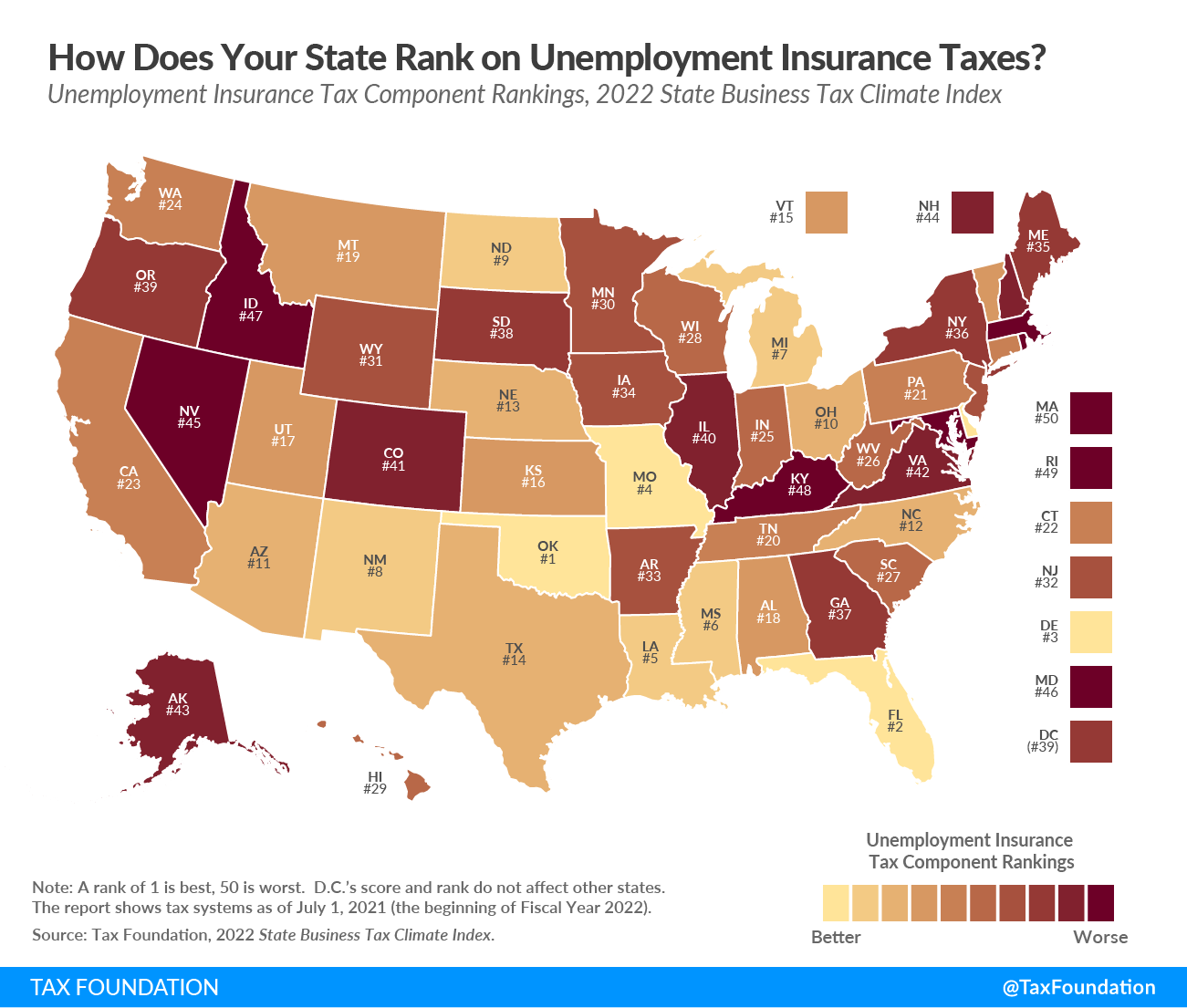

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Sales Taxes In The United States Wikiwand

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

General Sales Taxes And Gross Receipts Taxes Urban Institute

South Dakota Department Of Revenue Wondering How South Dakota S Sales Tax Rate Has Changed Through The Years See The Timeline Below Or You Can Visit Https Dor Sd Gov Businesses Taxes Sales Use Tax To View Current And Historical

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

Sales Use Tax South Dakota Department Of Revenue

U S Supreme Court Rules In State S Favor In South Dakota V Wayfair

South Dakota Income Tax Calculator Smartasset

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

A Bill To Eliminate Sales Taxes On Food Is In Sd S Legislative Hopper It S A Long Shot But Might Start Talk About Tax Reform The South Dakota Standard

Data Dive Which States Tax Groceries

How South Dakota Sales Tax Calculator Works Step By Step Guide 360 Taxes